Once they are used they become an expense that is recorded on your companys income statement as Supplies Expense according to Harold Averkamp creator and author of AccountingCoach. Likewise the credit of office supplies in this journal entry represents the office supplies used during the period.

Are Office Supplies A Current Asset Finance Strategists

Office equipment is the asset purchased by the organization which is used while working for the company.

. The correct balance needs to be determined. Any property that is convertible to cash that a business owns is considered an asset. Identify the following accounts as either an Asset Liability Equity Revenue or Expense.

Get the best reviews and recommendations on equipment and devices you can use to sanitize your home. Despite the temptation to record supplies as an asset it is generally much easier to record supplies as an expense as soon as they are purchased in order to avoid tracking the amount and cost of supplies on hand. The office supplies account is an asset account in which its normal balance is on the debit side.

These three categories are often and easily confused. Office supplies are items used to carry out tasks in a companys departments outside of manufacturing or shipping. Consider the following accounts.

Examples of office supplies commonly purchased by many businesses include writing utensils paper. Manufacturing supplies are items used in the. TaxesVAT calculated at checkout.

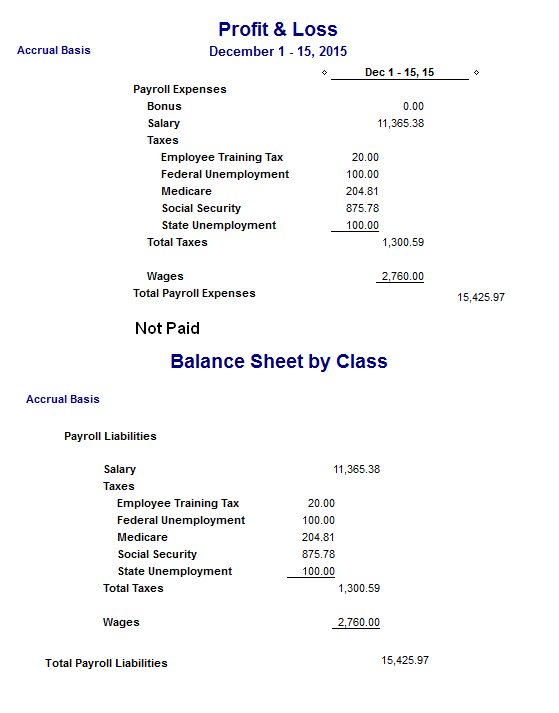

Service Revenue Asset g. The third large office equipment or furniture should each be classified as a fixed asset to be. Under the accrual basis of accounting some organizations record unused office supplies in an asset account such as Supplies on Hand and charge items to expense as they are consumed.

Examples of tangible assets include. In simple words supplies are assets until they are used. Your office expenses can be separated into two groups - office supplies and office expenses.

Heres a list of office supplies many businesses routinely purchase. We also ship internationally and happy to assist with a freight quote if requested. Hanging file folders can keep your office organized and your papers handy.

Unearned Fee Revenue d. Common Stock Equity d. Office supplies are considered current assets which means they need to be replenished often usually but not always within a business year.

Accounts Receivable Asset e. 16 746 users have favourite this asset. Supplies are a type of fixed asset -- they can be anything your company or organization relies on throughout the day to turn a profit.

Not enough ratings 17 users have favourite this asset. Supplies can be considered a. Office supplies are the kind of things that are utilized on a regular basis like stationary simple office accessories etc.

Its important to correctly classify your office expenses supplies and equipment to make things easier for tax time. For preparing products that are being shipped to customers. How to Classify Office Supplies on Financial Statements.

Prepaid Rent A chart of accounts is a list of all ledger accounts and an identification number for each. You can only deduct the cost of supplies you use in the current year so dont stock up near the end of the year. So in this journal entry total assets on the balance sheet decrease while the total expenses on the income statement increase.

For example a veterinary office maintains an inventory of medications. On the other hand Office Supplies are normally used for tracking Day-to-Day. Have that clutter-free home and workspace with Clean Sweep Supply.

If assets are classified based on their physical existence assets are classified as either tangible assets or intangible assets. Since refrigerators have a useful life that is more than a year you may include it under Furniture Fixtures and Equipments as long as it is categorized to a Fixed Asset account type. Tangible assets are assets with physical existence we can touch feel and see them.

In general supplies are considered a current asset until the point at which theyre used. The correct amount is the amount that has been paid by the company for. Thus consuming supplies converts the supplies asset into an expense.

Our experts also provide DIY tips on how you can better organize your home. Office Supplies Asset h. If any office supplies expenses or equipment cost over 2500 these become depreciable assets and you must depreciate these assets spread the cost out over time.

Staff continually have to track the quantities of those medicines in their inventory as well as the patient name and prescription. Office Equipment and Office Supplies. Once supplies are used they are converted to an expense.

Office supplies are assets until they are used or consumed. Shipping supplies are the cartons tape shrink wrap etc. The stock of Office Supplies at the end of the year is categorized as assets.

However the administrative effort required to do so does not usually justify the increased level of accounting accuracy and so is not recommended. Standard Unity Asset Store EULA. Clean Sweep Supply is the ultimate hub for your decluttering and cleaning needs.

Office supplies are likely to include paper printer cartridges pens etc. The equipment here means tables chairs computers etc. The balance in the asset Supplies at the end of the accounting year will carry over to the next accounting year.

Keeping Records to Prove Deductions. Office Supplies Consumed are categorized as an expense. The 1500 balance in the asset account Prepaid Insurance is the preliminary balance.

Mega Supplies is a family owned business and are proudly. When they are used they become an expense. Any property that is convertible to cash that a business owns is.

Click the icon to view the accounts Identify each account as Asset Liability or Equity. Type of account Liability a. Office Supplies Low Poly.

Office Expenses Vs Supplies What S The Difference Quill Com Blog

Stationery Is An Asset Or An Expense Online Accounting

Are Supplies A Current Asset How To Classify Office Supplies On Financial Statements

Chapter 9 2 Double Entry Accounting Accounting Debits Credits

Office Supplies Are They An Asset Or An Expense The Blueprint

Are Office Supplies Categorised As Assets Or Expenses Youtube

Are Office Supplies A Current Asset What You Should Know About Office Supplies The Freeman Online

/ExxonLongtermAssets2018-5c5485414cedfd0001efdb2c.jpg)

0 comments

Post a Comment